Your Trusted Sustainability Accounting Platform

Rio delivers more than compliance — we provide intelligence. Our platform translates sustainability ambitions into real-time, verifiable results, built on operational data and AI.

What you can achieve with Rio

Accurate, audit-ready sustainability data—beyond estimates, straight from your supply chain.

Key Features:

- Automated data ingestion from internal systems and supplier networks

- Real-time operational sustainability tracking of carbon, energy, water, and waste performance

- AI-powered anomaly detection to ensure data integrity and consistency

- Custom reporting engines aligned with ISSB, CSRD, SFDR and a range of other international regs and sector standards

- Multi-site rollouts for global operations with tailored configurations

Meet regulatory requirements with data you can trust.

Key Features:

- Direct supplier and asset-level integration for material ESG metrics

- Evidence gathering at scale across portfolios and value chains

- Automated disclosure alignment via the ‘Rio Compass’ for compliance with ISSB, CSRD, SFDR, and various regional frameworks

- Audit trails and version tracking to support assurance and verification

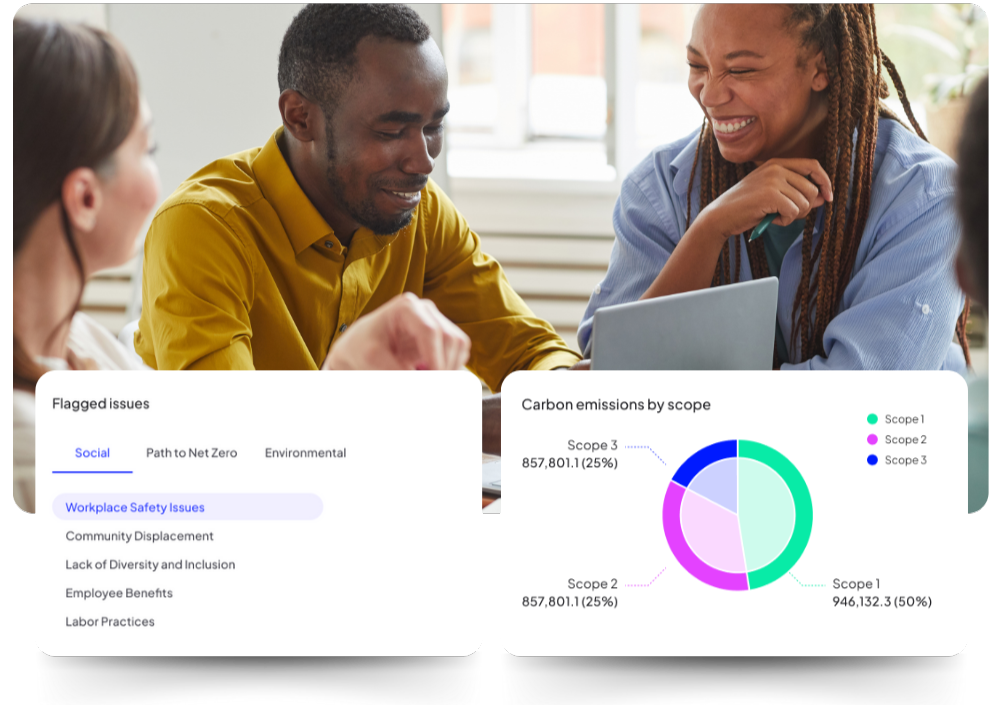

A real pathway to net zero—built on real data.

Key Features:

- Granular Scope 3 tracking with supplier-level emissions mapping

- Automated footprint calculations using verified methodologies

- Scenario planning and forecasting tools to assess interventions

- Efficiency analysis to uncover low-carbon, low-cost pathways

Transform sustainability reporting into a strategic asset.

Key Features:

- Executive-ready dashboards with real-time KPIs and board-level summaries

- AI-driven insights engine to surface operational inefficiencies and opportunities

- Benchmarking and peer comparison tools for internal and external reporting

- Supply chain intelligence to understand value chain impacts and hotspots

- Custom reporting outputs for investors, regulators, and stakeholders

Seamlessly integrate Rio into your business ecosystem.

Key Features:

- Plug-and-play APIs for ERP, finance, procurement, and carbon systems

- Modular architecture that supports bespoke workflows and data models

- Enterprise-grade security and access control for sensitive data environments

- White-label capability for partner or portfolio-wide rollout

- Dedicated onboarding & technical support for global deployments

What is a Sustainability Accountant?

Comprehensive ESG Coverage

Rio AI provides an enterprise-grade sustainability management platform built by domain experts. Our solution allows you to:

- Calculate carbon, energy, water and waste footprints to be audit-ready from day one

- Integrate more material environmental, social, economic or governance metrics

- Gain visibility across your operations, supply and value chain

- Benchmark performance and uncover cost-saving opportunities

- Streamline reporting with automated controls and audit trails

Drawing from decades of experience, our platform combines cutting-edge technology with robust accounting methodologies. Move beyond estimates and proxies to embedded data integrity you can stand behind.

Accurate sustainability data is key to strategic decision-making, disclosure requirements and driving long-term value. Rio AI empowers organisations to build trust and credibility through a solid data foundation.

Lead with confidence by making your sustainability data investment-grade.

Sustainability Accounting, Powered by Experts

Turn complexity into clarity with Rio’s Sustainability Accountants. Our in-house consultants work alongside your team to identify, calculate, and report the metrics that matter. Whether you are reporting from carbon and water to waste and social impact, we blend deep sector expertise with intelligent automation to deliver audit-ready, investor-grade sustainability data—consistently and confidently.

Ready to say goodbye to messy data?

You will meet with a Sustainability Expert who can answer any questions about regulations, value and best practices.

_logo.svg.png?width=800&height=323&name=National_Health_Service_(England)_logo.svg.png)