Zero Emissions Day has been designed to give the world a break from fossil fuels and to raise awareness about the harm caused by carbon emissions. The goal is to engage people towards more climate-friendly choices in their personal life.

Carbon emissions are at the forefront of the climate crisis, with governments mandating carbon reporting and more organisations pursuing net zero targets. With the increasing demand for carbon data, individuals and teams alike are searching for a simple and intelligent solution for carbon footprinting that reduces manual effort and increases accuracy.

But how do we accurately measure our carbon footprint? How do we offset carbon footprint and how do carbon offsets work? Let’s first look at the levels of carbon in the atmosphere.

The Global Carbon Project reported a ‘record fall’ in fossil-fuel emissions in 2020, with global carbon dioxide (CO2) emissions from fossil fuel and industry falling by 5.4% in 2020, (1) as economies around the world felt the effects of Covid-19 lockdowns.

Yet whilst this record decline is the largest absolute drop in emissions history, a comprehensive paper published in November 2021 in the Proceedings of the National Academy of Sciences(2), detailed some unexpected findings of the pandemic on the atmosphere.

The most surprising result was that, whilst CO2 emissions fell by 5.4% in 2020, the amount of CO2 in the atmosphere continued to grow at about the same rate as in preceding years. Notably, emissions returned to near-pre-pandemic levels by the latter part of 2020, despite reduced activity in many sectors of the economy. The authors reason that this rebound in emissions was probably necessary for businesses and individuals to maintain even limited economic productivity, using the worldwide energy infrastructure that exists today.

The study also offers insights into addressing the dual threats of climate warming and air pollution. “We’re past the point where we can think of these as two separate problems,” said Joshua Laughner, lead author of the new study and a postdoctoral fellow at Caltech in Pasadena, California. “To understand what is driving changes to the atmosphere, we must consider how air quality and climate influence each other.”

A further research paper from the Global Carbon Project details that, while CO2 emissions from extracting, transporting and burning fossil fuels make by far the largest contribution (an average of 81% over 1959-2019) to global emissions, a substantial portion (19%) come from land-use change.

Land-use emissions in 2020 are “similar to the previous decade’s average” at around 6GtCO2, the researchers say. This is lower than the “anomalously high emissions in 2019”, which saw the highest rates of deforestation in the Amazon since 2008 and huge fires across Indonesia’s carbon-rich peatlands.

Combining fossil and land-use emissions gives a total CO2 emissions of around 40GtCO2 in 2020, compared to 43GtCO2 in 2019, the researchers say.

These carbon “sources” are partially offset by carbon “sinks” that soak up a significant portion of human-caused emissions each year. The paper estimates that the ocean and land surface absorb an average of 24% and 32% of annual emissions, respectively.

This leaves around 45% of emissions that end up in the atmosphere each year. Here, they add to the accumulation of CO2 that is warming the Earth. Taken together, these elements are known as the “global carbon budget”.

(This differs from the commonly used term “carbon budget”, referring to the amount of CO2 that can be released while keeping warming below global limits of 1.5 or 2C.)(3)

Defining carbon offsetting due diligence.

Our Carbon Footprint is defined as the total amount of greenhouse gases produced to directly and indirectly support human activities, usually expressed in equivalent tons of carbon dioxide (CO2).

Offsetting is often included in an organisation's net zero strategy, however, it is important that due diligence is completed before purchasing offsets to ensure credibility. We highlight key points to look for in your due diligence and how to avoid low-quality offsets and provide authoritative sources for determining if an offset meets global standards.

Carbon offsetting due diligence is when you assess the quality, integrity, and credibility of your selected programs to make sure they contribute effectively to combating climate change. Certain aspects of carbon offsetting will be subjective and offset buyers should pay attention to all elements of a project’s quality. Projects should fulfil the following criteria to have a verified climate impact:

Real - emission reductions are quantifiable and permanent.

Measurable - all certified impacts are tracked transparently in a public registry.

Additional - the emission reductions would not have occurred if the project activity had not happened.

Independently verified - project activities and their impact data are verified by independent third parties.

Unique - carbon credits are not counted or claimed by any other party.

But how do businesses ensure they are verifying their carbon offset due diligence?

According to G&A’s 2021 Sustainability Reporting in Focus report, 92% of the S&P 500 companies published a sustainability report in 2020, up from 90% in 2019.

Businesses are under intense pressure from investors, regulators, employees, and customers to take measures towards sustainability and ESG disclosures are often one of the first steps on this journey. In fact, by 2025 it is predicted that 33% of all global AUM shall have ESG mandates. (4) And between 2018-2036 indicators predict growth of global assets to be $160tn. (5)

In addition to providing valuable information to consumers and investors, strong ESG policies create value for companies by reducing energy/water/waste costs, boosting employee productivity, attracting talent, and driving more strategic resource allocation.(6)

While many business leaders agree that ESG reporting is beneficial, they don’t all use the same reporting standards. In fact, there is a veritable alphabet soup of frameworks to choose from, designed by various non-profits, industry groups, and international organisations.

The result is too much of a good thing. Navigating these frameworks is tricky and choosing one or more that align with your goals can be difficult.

Carbon credit quality can be additionally tricky. There are approximately 600 to 700 million tonnes of old carbon credits available, many of which are no longer considered valid in terms of offsetting. Programs also provide some assurance of the quality of credits but not all certified credits are created equally. That’s why due diligence is so important. There are a few key points to take into consideration when selecting a project:

Avoid any credit owners that aren’t forthcoming with answers to questions about the project. It’s important to work with someone who is open and has who has a detailed understanding of the project types you’re considering.

Pay attention to the risk level of the credit. This often refers to choosing between environmental integrity requirements and social/environmental co-benefits. Usually, a project that benefits one sector, is often hard to measure for the other.

A strategy to address carbon credit quality risk is to purchase more carbon offsets than the volume of carbon emitted. By doing this, it hedges against the risk that some offsets may be of lower quality. It can also help buyers focus on reducing their own emissions as it increases the cost of offsetting.

Price or vintage (year of issue) isn’t a strong signifier of quality. Usually, very cheap offsets are a sign of low-quality projects where the additionality is probably weak, however, some projects are able to reduce GHG at a relatively low cost. Higher prices do not always mean higher quality. Vintage refers to the year the offset credit was issued or the year in which its associated GHG reduction occurred. It’s important to understand that the vintage of an offset credit does not indicate its quality- older vintages may be a quality concern if they have been unsold for a long time.

Reductions and due diligence are key

Organisations should first focus on reporting and reducing their GHG emissions in line with science-based targets in order to achieve net zero. Once an organisation has robust science-based targets in place, offsetting can then be used effectively to compensate for an organisation's unavoidable emissions.

The guidance on how to best achieve net zero emissions is constantly changing over time and there are already many elements of carbon offsetting that buyers need to consider to ensure they are investing in high-quality projects. Therefore, it’s important to stay on track using accountable, accurate and verifiable reporting. We believe that strategies, reporting and target setting need to be as straightforward as possible, in order for an organisation to effectively reduce their GHG emissions in effort to achieve net zero.

Rio is a hub for your sustainability solutions

We go beyond ESG. We provide real, tailored, transparent sustainability data at scale and on demand.

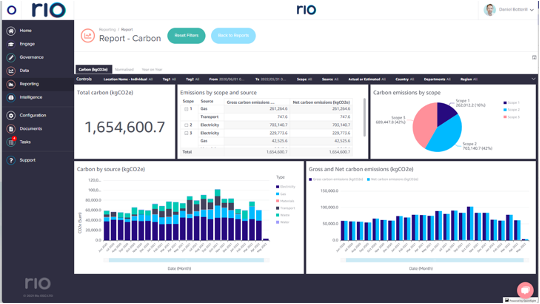

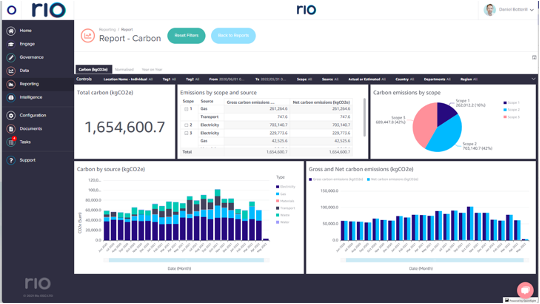

As a central hub for all your sustainability data, Rio is able to automate carbon reporting activities and help organisations improve efficiency on their path toward net zero.

Upload data from sources of your choice and Rio automatically calculates your organisation or portfolio’s carbon footprint using industry-standard guidance and conversion rates.

Rio allows you to compare performance across years or locations, set custom targets for reducing your footprint, and track performance against targets over time.

Corporate teams

In-house sustainability teams use Rio to calculate their organisation’s carbon footprint, track performance over time, set targets, and manage their carbon reduction strategy.

Consultants

Consultants use Rio to produce carbon footprints for their clients and provide strategic, data-driven recommendations for improvement. Rio removes the need for complex spreadsheets and simplifies tracking emissions on behalf of clients.

Investors

Financial professionals use Rio to produce carbon footprints at the portfolio or fund level, ensuring alignment with ESG and carbon legislation while also managing reputational and ESG risk.

Public sector

National and local government bodies use Rio to calculate their carbon footprint and manage their GHG reduction strategy. Entities can set targets and track performance, for example, against UK Greening Government Commitments.

At Rio, we’re all about making sustainability data and education more accessible. That’s why we put together this guide. We want to help you cut through the noise and choose the best ESG reporting framework(s) for your business, so you can get down to doing what really matters — implementing meaningful change.

Our guide to net zero outlines 10 highly actionable steps any organisation can take to begin or progress their journey. Download your free copy below.