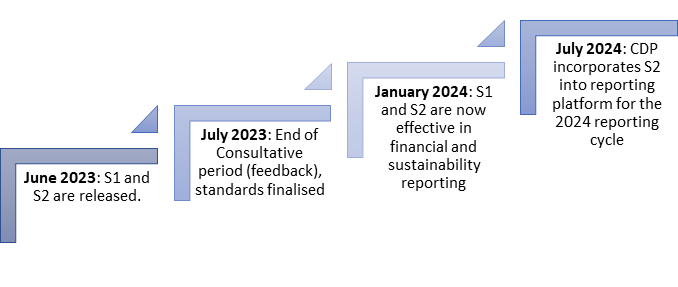

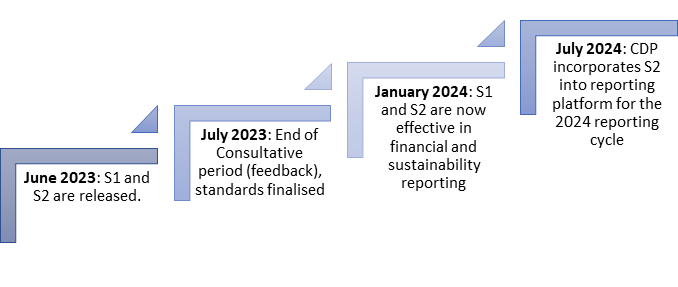

On 27 June 2023, under the IFRS Foundation (International Financial Reporting Standards), the ISSB (International Sustainability Standards Board) released the S1 and S2 reporting standards.

These standards: S1 General requirements for disclosure of sustainability related information and S2: Climate-related disclosures are aimed at consolidating a multitude of climate disclosure standards into a common baseline. Targeted towards communicating climate risks and opportunities to investors, these standards are structured to speak the same language utilised in annual financial reporting.

Who are the IFRS, ISSB and how do these standards relate to existing reporting disclosures?

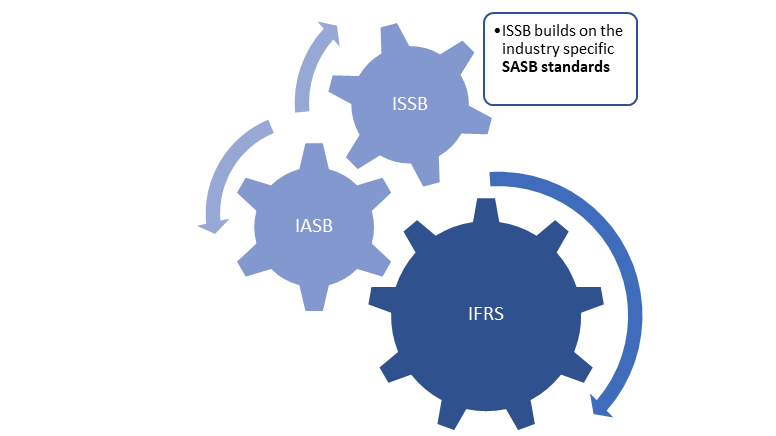

IFRS: International Financial Reporting Standards

As per their website: “As a public interest organisation, IFRS Develops high-quality, global standards that result in corporate information which informs investment decisions.”

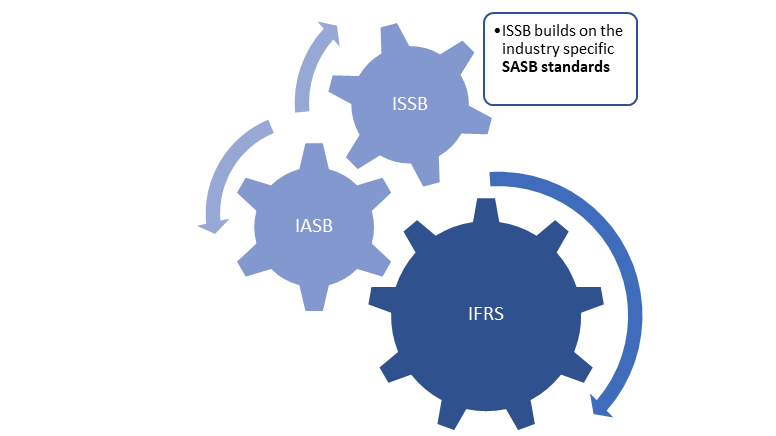

The IFRS maintain governance and oversight over the International Accounting Standards Board (IASB), responsible for the IFRS Accounting Standards and International Sustainability Board (ISSB), responsible for the IFRS Sustainability disclosure standards. The IASB and ISSB are independent and complementary to each other.

IASB: International Accounting Standards Board

The IASB is the standard setter for the IFRS Accounting Standards for traditional financial accounting, and works closely with the ISSB which focuses on developing the IFRS sustainability disclosure standards.

ISSB: International Sustainability Standards Board

In response to growing market demand, the ISSB were formed in November 2021 during COP26 to build on existing investor-focused reporting initiatives—such as SASB Standards—to deliver a global baseline for sustainability disclosures to the capital markets.

Ultimately, the ISSB aim to develop a standardised way in which organisations can communicate sustainability related risks to investors.

SASB: Sustainability Accounting Standards Board

SASB Standards are designed to identify and standardise disclosure for the sustainability issues most relevant to investor decision-making in each of 77 industries.

Figure 1: Interactions between IFRS, IASB, ISSB, and SASB

What do these standards mean for your organisation and existing reporting requirements?

With multiple corporate climate disclosures already in existence, the ISSB aimed to consolidate and integrate these frameworks into one standard, through the release of S1 and S2 guidance. These new standards seek to reduce the duplication which occurs across multiple disclosure reports and cut through what is referred to ESG’s “alphabet soup” of reporting recommendations and frameworks.

Where do these existing standards and frameworks fit?

• Existing ISSB Standards: serve as the baseline upon which S1 and S2 are built.

• GRI (Global Reporting Initiative): S1 and S2 have some overlap, but the GRI will go further than what is required under S1 and S2, serving as an influence but not consolidated in the new standards.

• TCFD (Task Force for Climate-Related Disclosures): S1 and S2 fully integrate and build upon the TCFD framework. For organizations currently reporting in line with TCFD recommendations, addressing S1 and S2 will eliminate the need for a separate TCFD exercise.

• CDP (Carbon Disclosure Project): Starting in January 2024, the CDP will align their reporting platform fully with the recommendations of S2.

• WEF (World Economic Forum): S1 and S2 receive full support and are influenced by the ESG reporting pillars from the World Economic Forum.

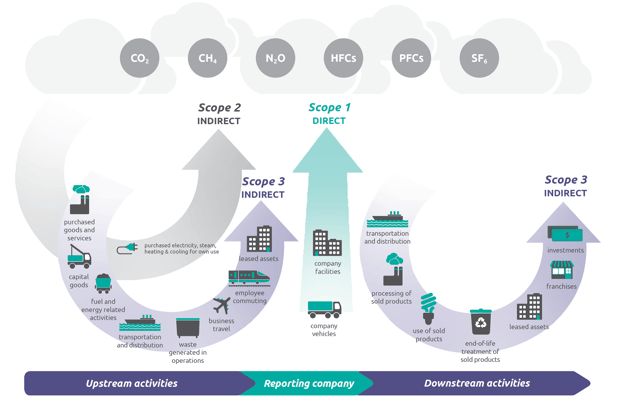

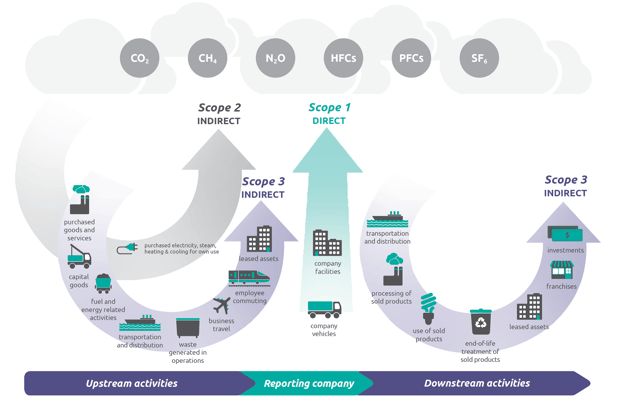

• GHG Protocol: is the standardized methodology for emissions calculations of S1 and S2 (However, if organisations are utilising a different calculation methodology, the IFRS has relief measures in place where the existing methodology may be allowed in the first year of reporting. Afterwards, all organisations are required to align with the GHG Protocol)

• IASB: S1 and S2 are aligned to the IASB to support the integration of sustainability and financial reporting

• SASB: Are asked to be considered in S1 and S2 but are not required if deemed not applicable

Upon their release in June 2023, these standards are not mandatory but are highly encouraged for voluntary reporting. However, looking forward, these standards have the potential to become mandatory as various jurisdictions (including the United Kingdom) across the globe are currently discussing if S1 and S2 will become legal reporting requirements.

What does S1: General Requirements for Disclosure of Sustainability-related Financial Information require?

IFRS S1 sets out the requirements for disclosing information about an entity’s sustainability-related risks and opportunities. In particular, an entity is required to provide disclosures about:

- the governance processes, controls and procedures the entity uses to monitor, manage and oversee sustainability-related risks and opportunities;

- the entity’s strategy for managing sustainability-related risks and opportunities;

- the processes the entity uses to identify, assess, prioritise and monitor sustainability-related risks and opportunities; and

- the entity’s performance in relation to sustainability-related risks and opportunities, including progress towards any targets the entity has set or is required to meet by law or regulation.” (IFRS, 2023)

What does S2: Climate-related disclosures require?

Applicable to both physical and transition risks, IFRS S2 is intended to be used in conjunction with the 4 key disclosures listed in S1 and includes guidance on:

- Scenario analysis: IFRS S2 includes application guidance on how to apply scenario analysis (building on TCFD materials).

- Requires method of climate-related scenario analysis commensurate with the company’s circumstances

- Use of reasonable and supportable info that is available at the reporting date without undue cost

- The Disclosure of Scope 1,2, and 3 GHG Emissions

- As part of the first-year reliefs, scope 3 will not be required in the first reporting year but will be required from the second year onwards

- Climate-related targets and transition plans (if a company has any)

- Companies with targets must provide:

- Characteristics of each target

- How the company sets and reviews each target

- The company’s performance against each target

- Emission reduction targets must include net or gross specification

How can Rio ESG help?

"The changes brought about by the IFRS Sustainability Disclosure Standards will require businesses to prioritize sustainability, enhance transparency, and align with investor expectations. While these changes may present challenges in terms of data management and reporting, they also offer opportunities for businesses to differentiate themselves, attract capital, and build long-term resilience. Embracing sustainability and effectively communicating sustainability efforts will be key for businesses to thrive in an evolving business landscape," says Dan Botterill, CEO of RIO.

Our comprehensive carbon accounting and ESG data tracking software can help your organisation collect, calculate, and disclose your Greenhouse gas emissions in alignment with the GHG protocol and the ISSB reporting standards.

Led by experts in sustainability, we have experience in supporting organisations in their TCFD reporting journeys and the development of their carbon reduction targets and strategies.